EmpowerLend AI - Loan Decision-Making Powered by AI

Our Objective

At EmpowerLend AI, our goal is simple: to make it easier for women-owned small businesses to access fair loans. We use AI technology to assess loan applications in a way that’s unbiased and accurate, helping more women get the financial support they need. Beyond loans, we’re here to empower you with financial education and mentorship, so you can grow your business with confidence.

Technical Overview

The EmpowerLend AI platform leverages advanced machine learning techniques, specifically utilizing a neural network model built with TensorFlow, to predict loan approvals based on data gathered from the Small Business Administration (SBA). The data is first cleaned and preprocessed, with irrelevant columns dropped and categorical data one-hot encoded. Date columns are converted into relevant numerical formats. The data is then normalized using a `StandardScaler`, ensuring that features have a mean of 0 and a standard deviation of 1. After splitting the data into training and testing sets, the neural network, designed with multiple hidden layers, is trained to predict whether a loan will be paid in full. The trained model and the scaler are saved for use in the application, allowing new user data to be processed efficiently and predictions to be generated accurately.

Explore the EmpowerLend AI Prototype

We’ve developed a prototype to demonstrate how our AI-driven loan assessment works. See the platform in action, and experience how it can help assess your loan eligibility in a fair and unbiased way.

Try the Prototype NowWatch a Demo

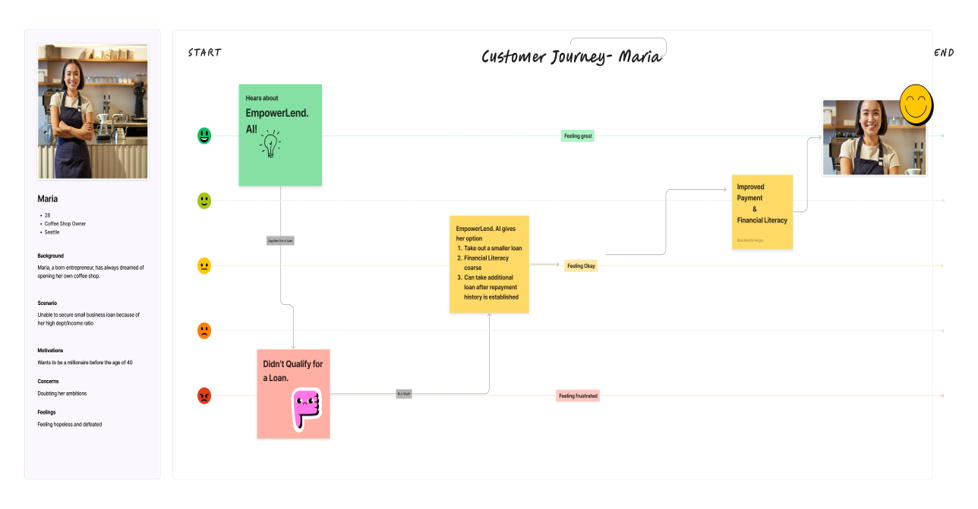

View a recorded walkthrough of the platform, where we explain how it works, step-by-step, and what you can expect when using it. Customer: Maria Doe

User Roadmap

Our journey is built around the entrepreneur. Here’s what you can expect as you interact with EmpowerLend AI: